Finio Loans: Review, Application, Interest Rates 2025

Finding the right loan provider can be a challenge, especially with so many options available in the UK market. One lender that has gained attention is Finio Loans, a company offering a variety of personal and business loan products.

In this guide, I’ll walk you through a complete review of Finio Loans, covering everything from loan types and application processes to interest rates, eligibility, and customer reviews.

What is Finio Loans?

Finio Loans is a UK-based lender that provides a range of loan products aimed at individuals and small businesses.

Whether you’re looking to consolidate debt, finance a major purchase, or fund a business venture, Finio offers flexible loan options to suit different needs. What sets them apart is their focus on fast online applications, competitive interest rates, and flexible repayment terms.

They aim to make borrowing as straightforward as possible, offering an entirely digital application process, which means you can apply and manage your loan online without visiting a branch.

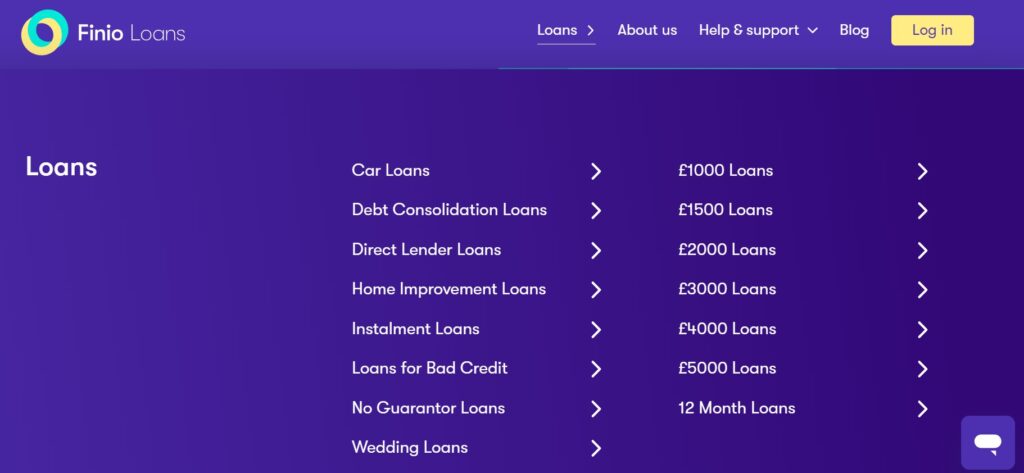

What Are the Different Loan Types Available in Finio?

Finio offers several types of loans tailored to meet various financial needs. Here’s an overview of their key loan offerings:

- Personal Loans: These are unsecured loans for individuals looking to finance personal expenses such as home improvements, holidays, or debt consolidation. Loan amounts typically range from £1,000 to £25,000.

- Business Loans: Designed to help small and medium-sized businesses with working capital or expansion, these loans can range from £5,000 to £50,000, depending on the business’s size and financial health.

- Payday Loans: For those who need quick cash to cover short-term expenses, Finio also offers payday loans, though these usually come with higher interest rates.

Each loan type comes with its own set of terms, eligibility criteria, and interest rates, so it’s essential to choose the one that best suits your financial situation.

Who Is Eligible for Finio Loans?

Eligibility for Finio Loans depends on several factors. Generally, to apply for a loan, you’ll need to meet the following criteria:

- Age: You must be at least 18 years old.

- Residency: You must be a UK resident with proof of address.

- Income: You need to demonstrate a stable income, whether through employment, self-employment, or business revenue (for business loans).

- Credit History: While Finio caters to a range of credit scores, a higher score generally improves your chances of approval and may secure you a lower interest rate.

- Bank Account: You must have a UK bank account in your name where the funds can be transferred and from which repayments will be made.

If you meet these criteria, you should have a good chance of being approved for a Finio loan, though specific loan types may have additional requirements.

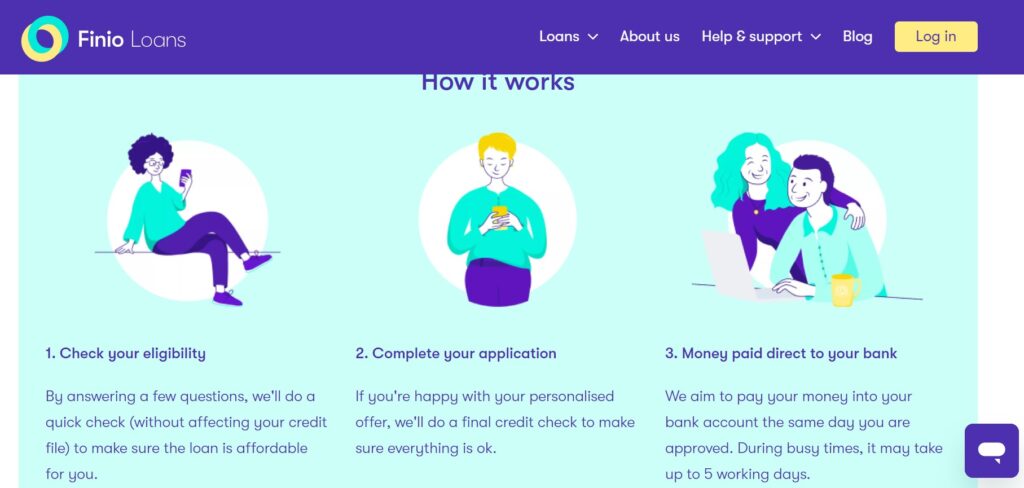

How to Apply for a Finio Loan?

Applying for a loan with Finio is simple and fully online. Here’s a step-by-step guide:

- Visit the Finio Website: Start by heading to their official website, where you can browse their loan options and select the one that fits your needs.

- Choose Your Loan Type: Whether you’re applying for a personal loan or business loan, select the appropriate option and fill in the required details, such as the amount you wish to borrow and the repayment term.

- Submit Your Details: You’ll need to provide personal information, including your name, address, income, and employment details. For business loans, you’ll need to submit financial statements or proof of business revenue.

- Upload Documentation: Be prepared to upload proof of ID, bank statements, and income verification documents. These help Finio verify your identity and assess your ability to repay the loan.

- Application Review: Once submitted, Finio’s team will review your application. You can usually expect a decision within 24 to 48 hours, though business loans may take a bit longer.

- Approval and Payout: If your loan is approved, the funds will be transferred directly into your UK bank account. Payouts are generally fast, with many applicants receiving funds within 24 hours after approval.

Can I Apply for Finio Loans with Bad Credit?

Yes, you can apply for a loan with Finio even if you have a poor credit history. Finio considers applications from individuals with varying credit scores, though your credit history will impact the interest rate you’re offered.

While borrowers with excellent credit can expect lower rates, those with bad credit might face higher interest rates. Finio may also set stricter terms or limit the loan amount available to applicants with poor credit.

If you have a low credit score, it’s important to ensure that the loan terms are manageable, as missing repayments can further damage your credit. Finio is one of the best options if you are looking for loans with bad credit.

How Long Does Finio Take to Payout the Loan?

Finio is known for its relatively fast payout process. For personal loans, if you’re approved, you can expect the funds to be transferred to your bank account within 24 hours.

For business loans, the payout process can take up to a few days depending on the complexity of the application and the amount being borrowed.

If you provide all required documentation upfront, it can speed up the approval and payout process. However, incomplete or inaccurate information could delay your loan.

What Are Finio Loan Interest Rates in 2025?

Interest rates are one of the most critical factors when choosing a loan, and Finio offers competitive rates. The annual percentage rate (APR) for Finio Loans typically ranges from 7.5% to 29.9%, depending on your credit score, loan amount, and repayment term.

- Excellent Credit: Borrowers with a strong credit score can expect the lowest rates, closer to the 7.5% mark.

- Average Credit: Those with average credit scores may be offered rates around 15-20%.

- Poor Credit: For applicants with poor credit, the rates can rise to as high as 29.9%.

Interest rates also vary depending on the type of loan. Personal loans tend to have lower rates than payday or short-term loans, which are riskier for lenders.

What Are the Loan Terms and Conditions with Finio?

When you take out a loan with Finio, you’ll need to agree to certain terms and conditions. These typically include:

- Repayment Terms: Loan repayment periods can range from 6 months to 5 years, depending on the loan amount and type.

- Early Repayment: Finio allows early repayment on most loans, but there may be a fee for paying off your loan early. Check the specific terms of your loan agreement.

- Late Fees: If you miss a payment, you could be subject to late fees. It’s important to set up a direct debit to avoid missing due dates.

- Restructuring: If you’re struggling to repay your loan, Finio may offer loan restructuring options to adjust the repayment terms.

Why Choose Finio Loans When Comparing to Other Loans?

When comparing Finio Loans to other lenders, there are several reasons why Finio might stand out:

- Fast Approval: Finio offers quick application processing and fast payout times, making it a convenient option for those in need of urgent funds.

- Flexible Terms: With repayment periods of up to 5 years, Finio provides flexibility for borrowers to spread their payments over a manageable timeline.

- Online Convenience: The entire process—from application to repayment—is done online, making it easier to apply and manage your loan without visiting a physical branch.

Compared to other lenders, Finio’s flexibility and competitive rates make it a solid choice for those looking for convenience and quick access to funds.

What Loan Type Is Suitable for Me in Finio?

Choosing the right loan depends on your personal or business needs:

- Personal Loan: Ideal for those needing funds for personal expenses like home improvements, consolidating debt, or financing a major purchase.

- Business Loan: Best suited for small to medium-sized business owners looking to expand their operations, hire new staff, or cover operational costs.

- Payday Loan: These are better for short-term financial needs but come with higher interest rates. Consider payday loans only if you’re sure you can repay them quickly.

Evaluate your financial situation and choose the loan type that aligns with your borrowing needs and repayment capacity.

What Are the Pros and Cons of Finio Loans?

Pros:

- Quick Online Application: No need to visit a branch, and approval can happen within 24 hours.

- Flexible Terms: You can choose a repayment period that suits your budget, from 6 months to 5 years.

- Loans for All Credit Types: Finio considers applications from individuals with various credit histories.

Cons:

- Higher Rates for Bad Credit: Borrowers with lower credit scores may face higher interest rates.

- Potential Fees: Some loans may include early repayment fees or late penalties, so be sure to read the fine print.

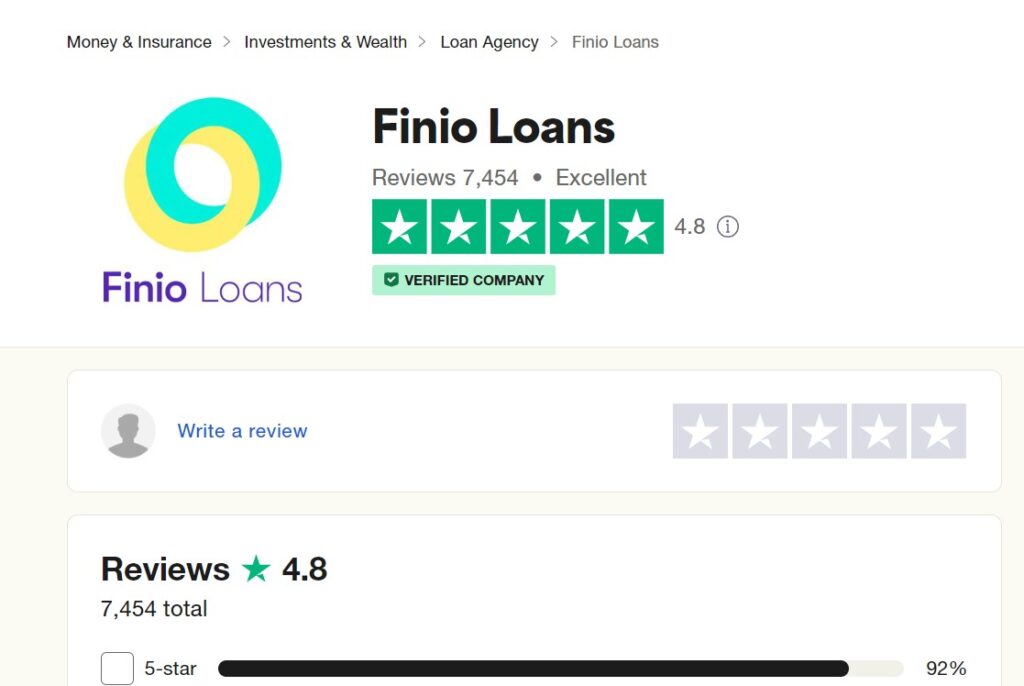

What Customers Say About Finio Loans? (Trustpilot Reviews)

Finio has received mixed reviews on platforms like Trustpilot. Many customers praise the platform’s quick approval process, easy-to-navigate website, and helpful customer service. Borrowers particularly appreciate the fast payout times, with many reporting receiving their funds within 24 hours.

However, some users have raised concerns about interest rates, especially for those with poor credit. There are also a few reports of issues with customer support during the repayment process. Overall, Finio has garnered a solid reputation, with the majority of reviews being positive.

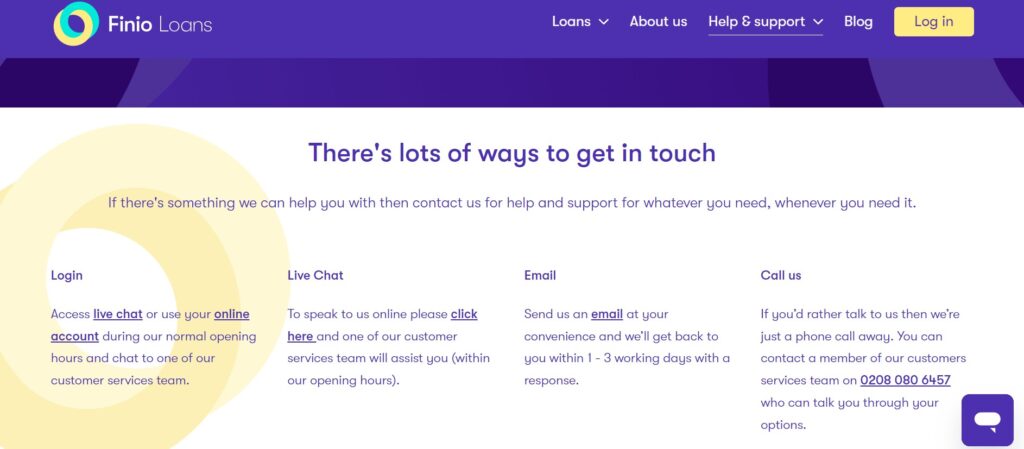

How to Contact Finio Loans?

If you need help or have questions about your loan application, you can reach out to Finio’s customer service team via several methods:

- Phone: You can call their customer support line during business hours for immediate assistance. Call at 0208 080 6457 to contact Finio Loans

- Email: For less urgent queries, you can send an email, and they typically respond within 24 to 48 hours.

- Online Chat: Some customers prefer the convenience of Finio’s online chat feature, where you can get instant answers to your questions.

Is Finio Loans Right for You?

If you’re looking for a lender that offers fast approval, flexible repayment options, and competitive interest rates, Finio Loans could be a good option for you. They cater to a wide range of borrowers, including those with bad credit, making them a versatile choice for many different financial needs.

However, if you have a low credit score, it’s important to be aware of the potentially higher interest rates and ensure that the repayment terms are manageable. Always compare different loan options and read the fine print before making a decision.

Conclusion

In 2025, Finio Loans continues to offer a convenient, online-focused lending solution for UK borrowers. Whether you’re looking for a personal loan or a business loan, Finio provides flexible terms, competitive interest rates, and a straightforward application process.

However, as with any financial product, it’s essential to understand the terms and conditions and ensure the loan fits your financial situation.

FAQ Section about Finio Loans

1. How much can I borrow with a Finio Loan?

Finio offers loan amounts ranging from £1,000 to £25,000, depending on the loan type and borrower’s creditworthiness.

2. Does Finio Loans charge early repayment fees?

Some loans may have early repayment penalties, but Finio offers flexible options. Always check the loan agreement for details.

3. Can I apply for a Finio Loan if I’m self-employed?

Yes, self-employed individuals can apply for Finio loans, though additional documentation regarding income may be required.

4. What’s the best way to increase my chances of loan approval?

Ensure that you meet all eligibility criteria, provide accurate documentation, and maintain a good credit score to improve approval odds.

5. What should I do if I’m struggling to repay my Finio Loan?

Contact Finio’s customer service to discuss possible loan restructuring or refinancing options to manage repayments.